Step into Comfort: The Ultimate Guide to ASICs Shoes

Discover the perfect blend of style and support with our expert reviews and insights on ASICs shoes.

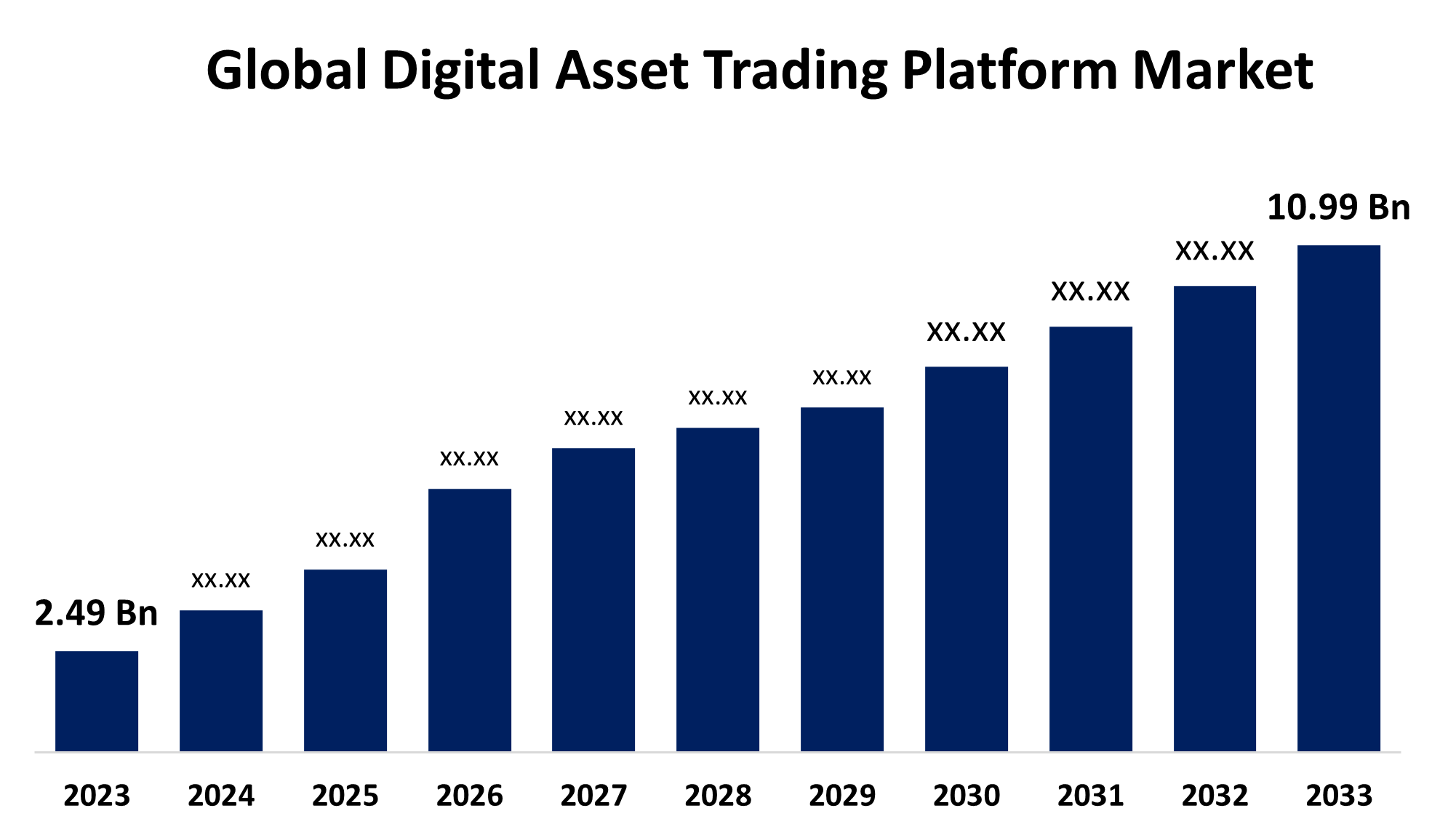

Why Digital Asset Trading is the New Black in Investment Circles

Discover why savvy investors are turning to digital asset trading as the hottest trend in finance. Don't miss out on the future of investing!

Understanding the Rise of Digital Assets: Why They're Dominating Modern Investment Strategies

The rise of digital assets has transformed the landscape of modern investment strategies, offering new opportunities and avenues for both individual and institutional investors. As traditional investment vehicles such as stocks and bonds face volatility, cryptocurrencies, non-fungible tokens (NFTs), and blockchain-based assets are gaining traction for their potential to yield substantial returns. The decentralized nature of digital assets not only enhances liquidity but also democratizes access to investment, allowing a broader range of participants to engage in the market.

Several factors contribute to the growing dominance of digital assets in investment strategies. Firstly, the increasing adoption of blockchain technology has provided a secure and transparent environment for asset trading, which builds trust among investors. Additionally, the proliferation of DeFi (Decentralized Finance) platforms has enabled users to lend, borrow, and earn interest on digital currencies, creating new income streams without reliance on traditional banking systems. As these trends continue, we can expect digital assets to solidify their position at the forefront of investment strategies.

Counter-Strike is a highly popular first-person shooter game that focuses on teamwork and strategy. Players can engage in competitive matches or casual gameplay, with various modes available. Many players often look for ways to enhance their experience, and using a daddyskins promo code can provide exciting in-game item discounts and rewards.

Digital Asset Trading 101: Key Concepts and Trends You Need to Know

Digital asset trading is revolutionizing the financial landscape, allowing individuals and institutions to exchange assets like cryptocurrencies, NFTs, and other blockchain-based items. At its core, digital asset trading involves the buying and selling of these assets on various platforms, known as exchanges. Key concepts in this domain include blockchain technology, which ensures secure and transparent transactions, alongside wallets that enable users to store their digital assets safely. As you delve into this rapidly evolving market, understanding liquidity, which refers to how easily an asset can be bought or sold, and volatility, the degree of price fluctuations, will be crucial for making informed trading decisions.

Several notable trends are shaping the future of digital asset trading. For instance, the rise of decentralized exchanges (DEXs) has empowered users by allowing trades without an intermediary, leading to increased privacy and control over assets. Furthermore, Regulatory frameworks are becoming more defined, with governments worldwide seeking to create guidelines that protect investors while fostering innovation. Lastly, the integration of Artificial Intelligence (AI) and machine learning in trading strategies is transforming how traders analyze market data, making it easier to predict trends and make informed decisions. Keeping an eye on these trends will equip you with the knowledge needed to navigate the digital asset trading landscape effectively.

Is Digital Asset Trading the Future of Investing? Exploring Opportunities and Risks

The rise of digital assets, including cryptocurrencies and tokenized assets, has sparked considerable interest among investors. Digital asset trading presents a unique opportunity to diversify investment portfolios and tap into emerging markets. With the increasing adoption of blockchain technology, investors can engage in peer-to-peer transactions, enhancing liquidity and reducing reliance on traditional financial institutions. Moreover, the transparency and security offered by decentralized platforms present compelling reasons for both seasoned and novice investors to explore this new realm of investing.

However, while the potential benefits of digital asset trading are significant, it also comes with its own set of risks. Market volatility remains a major concern, as the value of digital assets can fluctuate dramatically in a short period. Additionally, regulatory challenges pose risks for investors, as governments across the globe grapple with how to manage this rapidly evolving landscape. As with any investment strategy, it’s crucial to conduct thorough research and adopt robust risk management practices to navigate the opportunities and challenges of digital asset trading effectively.