Step into Comfort: The Ultimate Guide to ASICs Shoes

Discover the perfect blend of style and support with our expert reviews and insights on ASICs shoes.

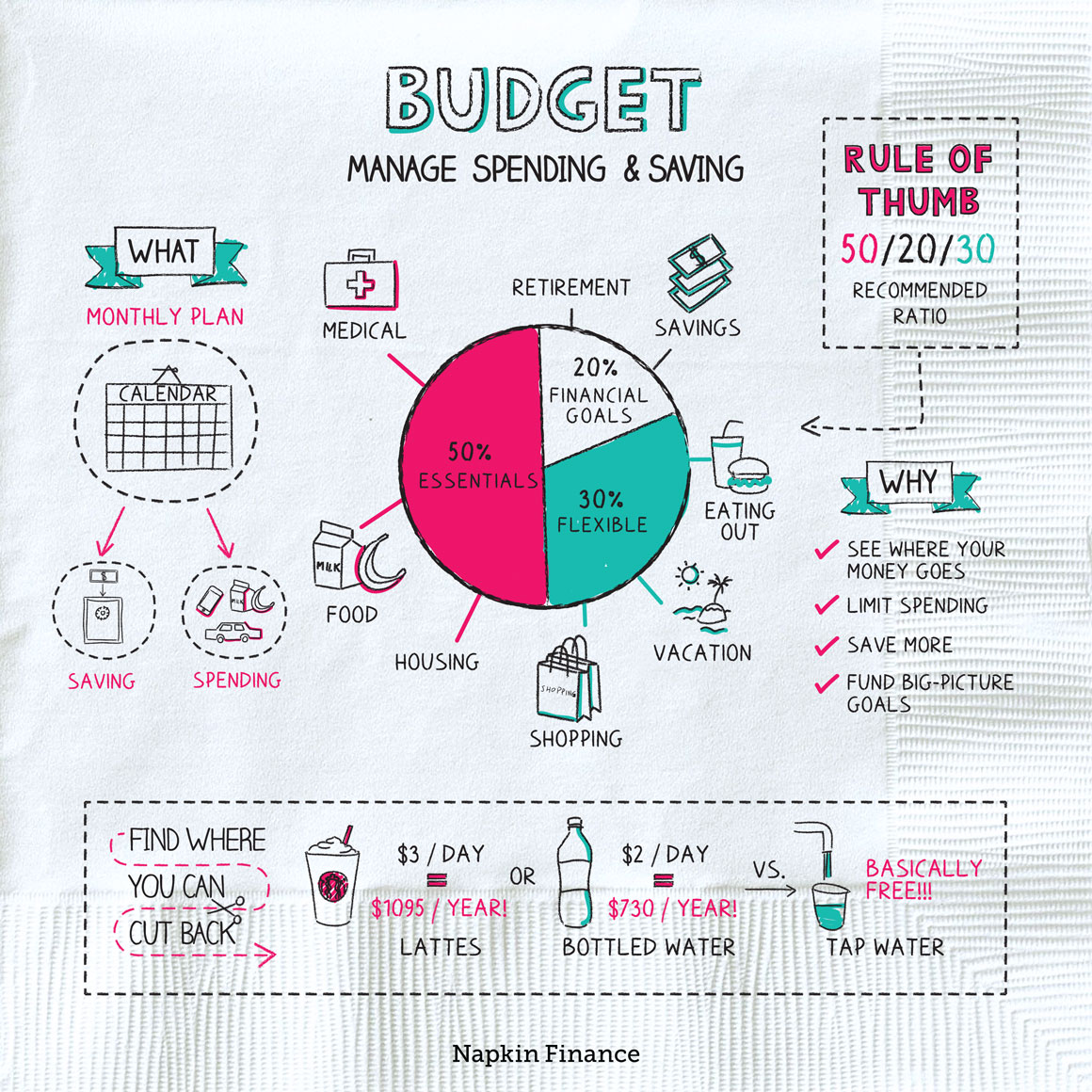

Budgeting for the Bold: Daring Your Wallet to Dream Big

Unlock your financial potential! Discover bold budgeting tips that challenge your wallet and empower your dreams. Dare to dream big today!

5 Bold Budgeting Tips to Help You Achieve Your Financial Dreams

When it comes to budgeting, adopting a bold approach can significantly impact your financial well-being. Here are 5 bold budgeting tips that can help you lay down the groundwork to achieve your financial dreams:

- Track Every Expense: Keeping a meticulous record of every penny spent provides transparency and highlights areas where you can cut back.

- Set Clear Financial Goals: Define your financial dreams, whether it’s saving for a home or reducing debt, and set specific, measurable milestones.

- Embrace the 50/30/20 Rule: Allocate 50% of your income to necessities, 30% to wants, and 20% to savings or debt repayment to ensure balanced financial health.

- Automate Savings: Set up automatic transfers to savings accounts so you can save without even thinking about it!

- Review and Adjust: Regularly assess your budget and adjust it as needed to ensure you stay on track with your financial goals.

These bold budgeting tips are designed to challenge conventional methods and propel you towards effective financial management. Remember, making significant financial changes requires commitment and discipline, but the rewards can be life-changing. In essence, adopting a proactive mindset towards budgeting can transform not just your finances, but your entire approach to financial dreams.

Counter-Strike is a highly popular multiplayer first-person shooter game that focuses on team-based gameplay. Players can choose to be part of either the Terrorists or Counter-Terrorists, each with unique objectives. For those looking to enhance their gaming experience, check out the Top 10 iPhone accessories under 100 to find some great gear that could help elevate your performance during intense matches.

How to Set Financial Goals That Inspire and Motivate You

Setting financial goals is a crucial step towards achieving not just financial stability, but also personal fulfillment. To set financial goals that inspire and motivate you, start by identifying your core values and what truly matters to you. Ask yourself questions like, What are my long-term dreams? and What lifestyle do I want to create? Once you have a clear vision, consider breaking your aspirations into specific, measurable, achievable, relevant, and time-bound (SMART) goals. For instance, instead of stating that you want to save money, specify, I will save $10,000 for a down payment on a house within the next two years.

To maintain your motivation as you work towards these goals, it's essential to track your progress and celebrate small victories along the way. Creating a visual representation of your goals, such as a vision board or a goal tracker, can help keep your aspirations at the forefront of your mind. Additionally, regularly revisiting and adjusting your goals as circumstances change will ensure they remain relevant and inspiring. Remember, financial goals are not merely targets; they should ignite your passion and drive you to take action every day. By aligning your financial objectives with your personal values, you'll cultivate the motivation needed to achieve them.

What Do You Really Want? Creating a Vision Board for Your Budget

Creating a vision board is an empowering way to clarify what you really want in life, especially when you are mindful of your budget. Start by gathering materials like magazines, scissors, glue, and a corkboard or poster board. Begin by reflecting on your goals in various aspects of life, including career, relationships, health, and finances. This will help you visualize what you desire most. Lay out your ideas and let your creativity flow. As you cut out images and words that resonate with your financial aspirations, you’ll not only define your dreams but also create a tangible representation that you can refer back to regularly.

Once your vision board is complete, place it in a spot where you’ll see it often. This constant reminder will help you stay aligned with your goals, prompting you to make budget-conscious decisions that support your vision. Consider incorporating specific budgeting tips to help you achieve what you want. For instance, you can set aside a small percentage of your income each month dedicated to your vision. By visualizing your goals and creating a practical plan to finance them, you’re taking actionable steps towards turning your dreams into reality.