Step into Comfort: The Ultimate Guide to ASICs Shoes

Discover the perfect blend of style and support with our expert reviews and insights on ASICs shoes.

Hidden Gems: Auto Insurance Discounts You Didn't Know Existed

Uncover secret auto insurance discounts and save big! Discover hidden gems that could trim your premium today!

Unlocking Savings: A Guide to Uncommon Auto Insurance Discounts

When searching for ways to save on auto insurance, many drivers focus on the most common discounts, such as safe driver or multi-car discounts. However, there are numerous uncommon auto insurance discounts that can significantly reduce your premiums. For instance, some insurance providers offer discounts for vehicles equipped with certain safety features like adaptive cruise control or automatic emergency braking systems. Additionally, many companies reward policyholders who have undergone defensive driving courses, providing an excellent opportunity to not only improve driving skills but also save money in the long run.

Another often-overlooked option is the low mileage discount. Drivers who use their cars sparingly, perhaps due to remote work or public transportation options, can benefit from lower premiums since they pose less risk on the road. Additionally, consider exploring discounts related to your profession or affiliations; many insurers partner with certain employers or organizations to provide tailored discounts to their members. Lastly, always inquire about loyalty discounts for staying with the same insurer for an extended period, as this can lead to substantial savings over time.

Are You Missing Out? Top 10 Hidden Auto Insurance Discounts Explained

When it comes to auto insurance, many drivers are unaware of the multitude of discounts that may be available to them. Are you missing out? Hidden discounts can significantly lower your premiums, making coverage more affordable. From safe driving incentives to discounts for bundling policies, understanding the various offerings is crucial. Here are the top 10 hidden auto insurance discounts you might be overlooking:

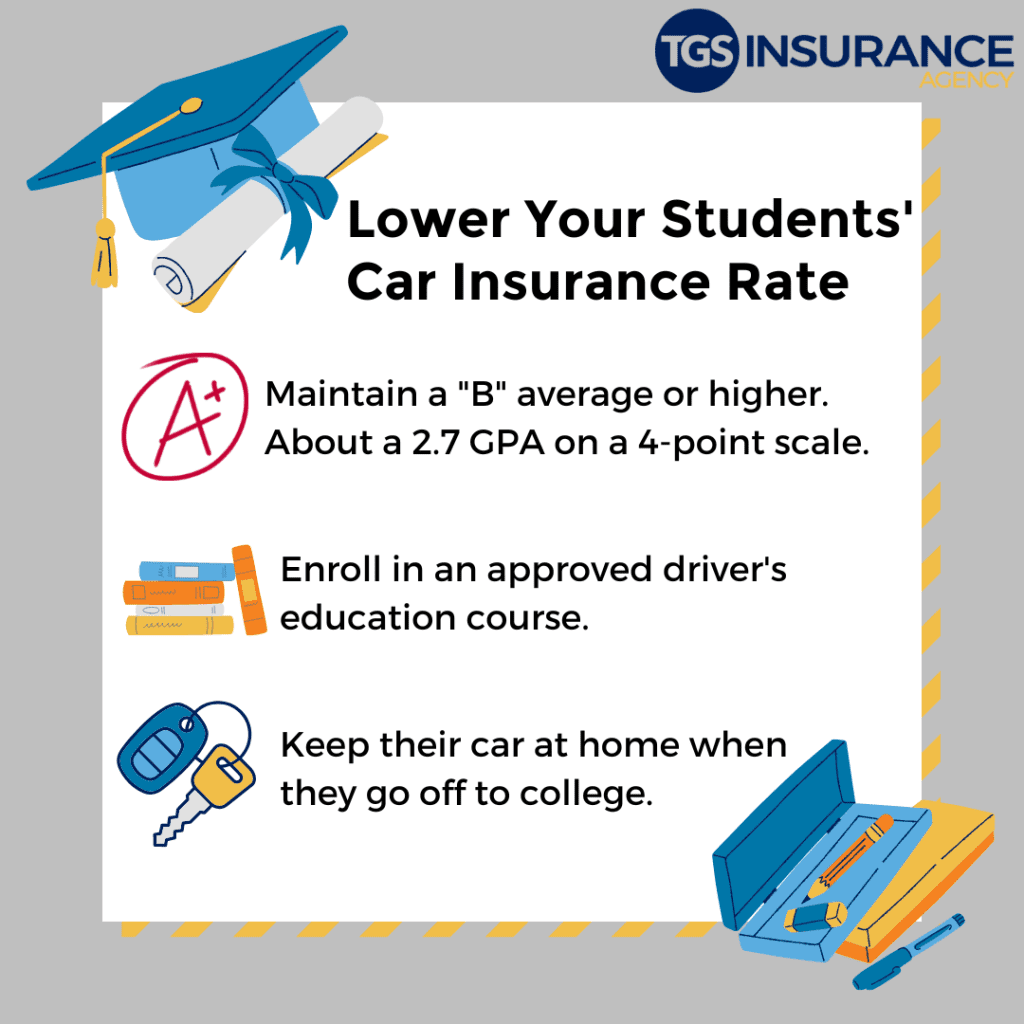

- Good Student Discount: Many insurers offer discounts for young drivers who maintain a high GPA.

- Low Mileage Discount: If you drive less than average miles, you could be eligible for savings.

- Safety Features Discount: Cars equipped with advanced safety features often qualify for reduced rates.

- Military Discount: Active duty members and veterans can benefit from special rates.

- Paid-in-Full Discount: Paying your premium all at once can sometimes lead to a discount.

- Loyalty Discount: Staying with the same insurer for several years may earn you a loyalty reward.

- Occupational Discount: Certain professions can qualify for unique discounts; check if yours does!

- Bundling Discount: Combining auto insurance with home or renters insurance often results in significant savings.

- Telematics Discount: Using a driving app to showcase safe driving habits can yield discounts.

- Referral Discount: Referring friends or family who purchase a policy can earn you additional discounts.

By being proactive and asking your insurer about these potential savings, you can make the most of your auto insurance policy and ensure you aren't leaving money on the table.

Save Big: How to Discover Overlooked Auto Insurance Discounts

Many drivers are unaware that they may be eligible for a variety of overlooked auto insurance discounts. Start by contacting your current insurer to inquire about discounts based on your driving history, such as a clean driving record or low mileage. Additionally, some companies offer discounts for bundling multiple policies, like home and auto, which can significantly reduce your overall premium. Don’t forget to ask about discounts for safety features in your vehicle, such as anti-lock brakes and airbags, which can further lower your costs.

Another effective way to uncover auto insurance discounts is to explore affiliations. Many organizations, employers, and even alumni associations have partnerships with various insurance companies, providing exclusive discounts to their members. Make sure to leverage any connections you have in these areas to maximize your savings. Lastly, consider shopping around and comparing quotes from different providers; you might find that some companies offer substantial discounts that are overlooked in your current policy.