Step into Comfort: The Ultimate Guide to ASICs Shoes

Discover the perfect blend of style and support with our expert reviews and insights on ASICs shoes.

Rev Your Savings: Discover the Best Auto Insurance Discounts

Unlock massive savings on auto insurance! Explore the best discounts and rev up your wallet today!

Top 10 Auto Insurance Discounts You Didn't Know About

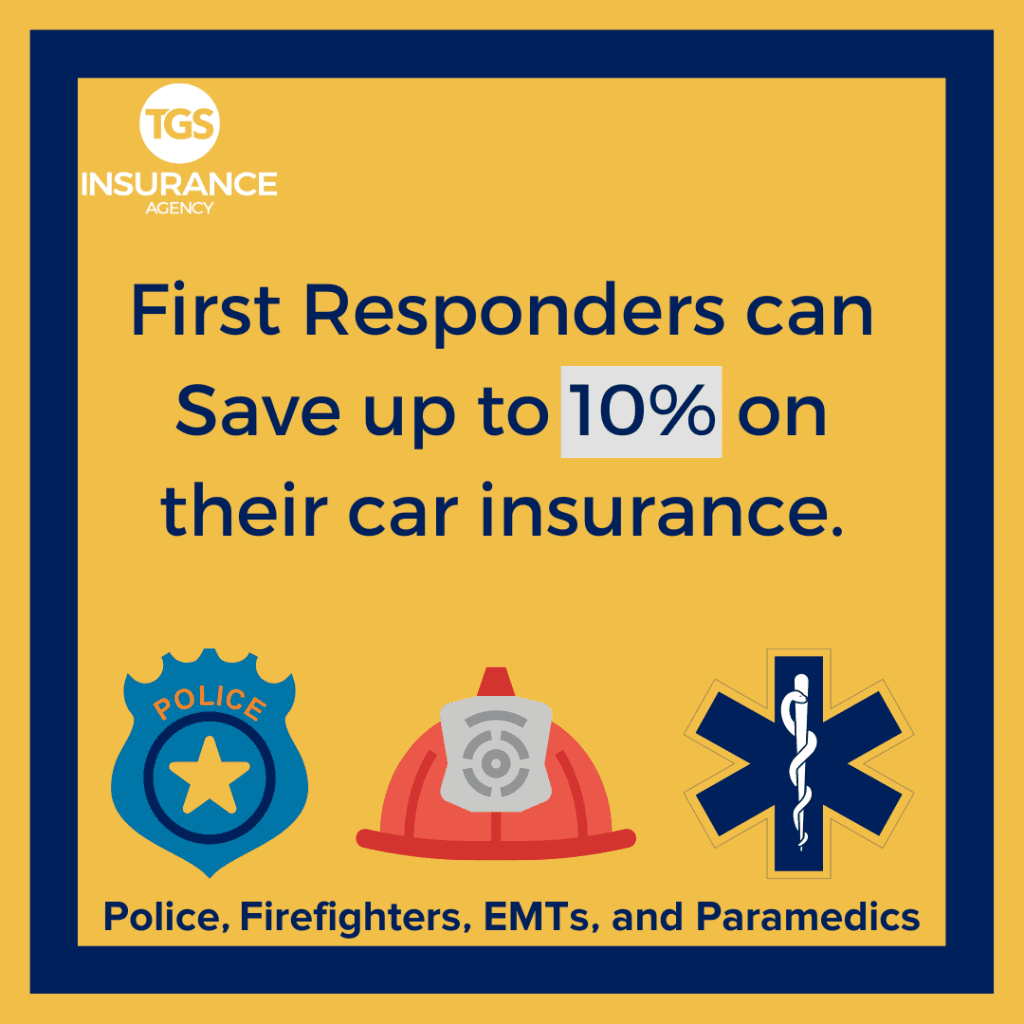

Finding the right auto insurance can be overwhelming, especially when you're trying to save money. Fortunately, many insurance providers offer a range of discounts that can significantly reduce your premiums. Here are some of the top auto insurance discounts that you might not be aware of:

- Good Driver Discount: If you maintain a clean driving record without accidents or traffic violations, you could qualify for a substantial reduction in your premium.

- Multiple Policy Discount: Bundling your auto insurance with other policies like home or renters insurance can lead to significant savings.

- Low Mileage Discount: Driving less than a certain number of miles per year can qualify you for a discount as it indicates a lower risk for the insurer.

- Safety Feature Discount: Vehicles equipped with advanced safety features, like anti-lock brakes and airbags, may earn you lower rates.

- Student Discount: Young drivers who maintain a good GPA may be eligible for discounts as insurers often view them as responsible.

- Retirement Discount: Seniors often qualify for discounts simply due to their age and experience behind the wheel.

- Military Discount: Active duty service members, veterans, and their families often receive special rates from providers.

- Defensive Driving Course Discount: Completing a defensive driving course can not only enhance your skills but also lower your premiums.

- Paperless Billing Discount: Opting for paperless statements can save you money, as many insurers provide incentives to go green.

- Claim-Free Discount: If you’ve been with your insurance provider for several years without making any claims, you may be eligible for a loyalty discount.

How to Qualify for the Best Auto Insurance Rates

Qualifying for the best auto insurance rates begins with understanding the factors insurance companies consider when determining premiums. Key elements include your driving record, the type of vehicle you drive, and your credit score. Keeping a clean driving history free of accidents and violations is crucial; most insurers offer discounts for safe drivers. Additionally, opting for a vehicle with high safety ratings and low theft rates can result in lower premiums. It’s also wise to maintain a good credit score, as many insurers leverage this to assess risk.

Another effective way to qualify for the best auto insurance rates is through bundling policies and taking advantage of available discounts. For instance, purchasing both auto and home insurance from the same provider can lead to significant savings. Don’t hesitate to ask about discounts for specific affiliations, such as being a member of certain organizations, or for completing driver safety courses. Additionally, regularly reviewing and comparing quotes from different providers allows you to find the most competitive rates tailored to your specific needs.

Are You Missing Out on These Auto Insurance Savings Opportunities?

Auto insurance can be a significant monthly expense for many drivers, but what if you're missing out on valuable savings opportunities? Many people are unaware of various savings programs that insurance companies offer, which can drastically reduce your premiums. For instance, multi-policy discounts can save you money if you bundle your auto insurance with your homeowner’s or renter’s insurance. Additionally, some insurers offer discounts for low mileage, safe driving records, and even for completing defensive driving courses. By exploring these options, you could potentially save hundreds of dollars each year.

Another area where you might be leaving money on the table is in your choice of coverage. Reviewing your deductibles and adjusting them can lead to lower monthly payments. Remember, a higher deductible usually results in a lower premium, but it’s essential to choose an amount you can afford in case of a claim. Furthermore, regularly reassessing your auto insurance policy can unveil additional savings as your needs change. Don't hesitate to shop around and compare quotes from different providers; you might find a better rate or even a new discount you hadn’t considered before!